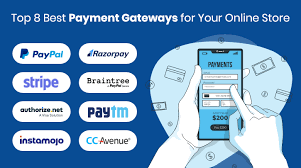

Introduction to Popular Online Payment Platforms

In today’s digital age, online payment platforms have become an integral part of our daily lives, revolutionizing the way we conduct transactions. From purchasing goods and services to sending money to friends and family, these platforms offer convenience, security, and efficiency. In this article, we will explore some of the most popular online payment platforms that have transformed the landscape of e-commerce and digital finance.

PayPal: Pioneer in Online Payments

History and Evolution

PayPal stands as one of the pioneering platforms in the realm of online payments. Founded in 1998, initially as a security software company, PayPal quickly pivoted to become a digital wallet service, enabling users to make online transactions securely. Over the years, it has grown exponentially, expanding its services globally and catering to millions of users worldwide.

Features and Benefits

With PayPal, users can link their bank accounts, credit cards, or debit cards to their accounts, facilitating seamless transactions across various online platforms. Its user-friendly interface and robust security measures, including encryption and fraud detection algorithms, have earned it the trust of both consumers and merchants alike.

Security Measures

PayPal prioritizes the security of its users’ financial information, employing advanced encryption techniques to safeguard transactions. Additionally, it offers buyer and seller protection programs, providing peace of mind to both parties involved in a transaction.

Stripe: Revolutionizing Payment Processing

Founding and Growth

Stripe emerged in 2010 with a mission to simplify online payment processing for businesses of all sizes. Founded by Irish entrepreneurs Patrick and John Collison, the platform quickly gained traction, attracting notable clients such as Lyft, Shopify, and Airbnb. Its innovative approach to payment infrastructure revolutionized the industry, offering customizable solutions tailored to the needs of modern businesses.

Services Offered

Stripe offers a comprehensive suite of payment services, including payment processing, subscription management, and fraud prevention tools. Its developer-friendly APIs and robust documentation make integration seamless for businesses across various industries, empowering them to scale efficiently.

Integration and User Experience

One of Stripe’s key strengths lies in its seamless integration capabilities with popular e-commerce platforms and mobile applications. Its intuitive dashboard provides real-time insights into transaction data, enabling businesses to make informed decisions and optimize their revenue streams effectively.

Square: Empowering Small Businesses

Overview and Background

Square was founded in 2009 by Twitter co-founder Jack Dorsey with the aim of democratizing access to financial services for small businesses. Initially known for its mobile card reader, Square has since expanded its product lineup to include point-of-sale systems, invoicing tools, and business financing solutions.

Products and Solutions

Square offers a range of products and solutions tailored to the needs of small businesses, including Square Reader for contactless and chip payments, Square Terminal for in-store transactions, and Square Register for comprehensive point-of-sale functionality. Its user-friendly interface and transparent pricing structure make it an attractive option for entrepreneurs and small business owners.

Accessibility and Affordability

One of Square’s biggest advantages is its accessibility and affordability, particularly for small businesses with limited resources. There are no monthly fees or long-term contracts, and businesses only pay for the services they use, making it a cost-effective solution for startups and SMBs.

Venmo: Social Payments Simplified

Origin and Concept

Venmo was founded in 2009 with a vision to simplify peer-to-peer payments through a social networking-inspired platform. Acquired by PayPal in 2013, Venmo gained popularity among millennials and Gen Z users for its social feed feature, which allows users to share payment activities with friends and contacts.

Functionality and Usage

Venmo allows users to send and receive money easily using their mobile devices, eliminating the need for cash or checks. Its social integration and emoji-based transaction descriptions add a playful element to the payment experience, making it popular among younger demographics.

Privacy and Security Features

Despite its social features, Venmo prioritizes user privacy and security, employing encryption and authentication measures to protect users’ financial information. Additionally, it offers optional privacy settings, allowing users to control who can view their payment activities on the platform.

Google Pay: The All-in-One Payment Solution

Development and Integration

Google Pay evolved from Google Wallet and Android Pay, consolidating various payment services into a single platform. Launched in 2018, Google Pay offers a unified payment experience across devices, enabling users to make payments in-store, online, and in-app seamlessly.

Features and Compatibility

Google Pay supports a wide range of payment methods, including credit cards, debit cards, and bank accounts, making it convenient for users to manage their finances in one place. Its integration with Google services such as Gmail and Google Assistant further enhances its functionality, providing users with personalized recommendations and reminders.

User Interface and Convenience

With its sleek interface and intuitive design, Google Pay prioritizes ease of use and convenience for its users. Whether it’s splitting bills with friends, paying for groceries at the store, or booking flights online, Google Pay streamlines the payment process, saving users time and effort.

Conclusion

In conclusion, popular online payment platforms have revolutionized the way we manage our finances and conduct transactions in the digital age. From industry pioneers like PayPal to innovative newcomers like Stripe and Venmo, these platforms offer convenience, security, and flexibility to users worldwide. Whether you’re a small business owner, a freelancer, or an everyday consumer, choosing the right payment platform can significantly enhance your financial experience and simplify your life.

Unique FAQs

- Are online payment platforms safe to use?

- Yes, reputable online payment platforms employ advanced security measures such as encryption and fraud detection to safeguard users’ financial information.

- Can I use multiple payment platforms simultaneously?

- Yes, many users choose to utilize multiple payment platforms to take advantage of different features and benefits offered by each platform.

- Are there any fees associated with using online payment platforms?

- Some platforms may charge transaction fees or subscription fees for certain services, while others offer free basic accounts with optional premium features for a fee.

- How do online payment platforms make money?

- Online payment platforms typically generate revenue through transaction fees, subscription fees, and value-added services such as payment processing and financing.

- Are online payment platforms regulated by financial authorities?

- Yes, online payment platforms are subject to regulatory oversight by financial authorities in various jurisdictions to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.