Evolution of Online Payment Systems

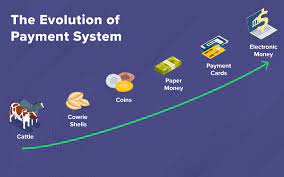

Online payment systems have undergone a remarkable evolution over the years, revolutionizing the way transactions are conducted in the digital age. From humble beginnings to the sophisticated platforms we see today, the journey of online payments has been marked by innovation, challenges, and continuous adaptation to meet the needs of consumers and businesses alike.

Introduction

Online payment systems refer to the mechanisms that enable individuals and businesses to conduct financial transactions over the Internet. These systems have become an integral part of everyday life, facilitating purchases, bill payments, and money transfers with ease and convenience. The evolution of online payments has been driven by technological advancements, changing consumer preferences, and the growing demand for secure and efficient transaction methods.

Early Forms of Online Payments

The concept of online transactions can be traced back to the 1970s with the advent of the internet. However, it was not until the 1990s that online payments began to gain traction with the introduction of credit cards and electronic transfers. These early forms of online payments laid the foundation for the digital economy, allowing businesses to expand their reach beyond geographical boundaries.

Emergence of E-commerce and Need for Secure Payments

The rise of e-commerce platforms in the late 20th century further fueled the demand for secure online payment systems. As more consumers embraced online shopping, concerns regarding security and fraud became prominent. This led to the development of robust encryption techniques and security protocols to safeguard sensitive financial information during transactions.

Birth of Online Payment Gateways

In response to the growing need for secure online payments, payment gateways emerged as a vital component of e-commerce infrastructure. These gateways serve as intermediaries between merchants and financial institutions, facilitating seamless transactions while ensuring the integrity and security of the payment process. Payment gateways play a crucial role in authenticating transactions, detecting fraud, and processing payments in real time.

Integration of Mobile Payments

The proliferation of smartphones and mobile devices has transformed the way people engage in online transactions. Mobile payments have become increasingly popular, thanks to the convenience and flexibility they offer. The introduction of mobile wallets and Near Field Communication (NFC) technology has enabled users to make payments using their smartphones, eliminating the need for physical cards or cash.

Cryptocurrency and Blockchain Revolution

One of the most significant developments in recent years has been the emergence of cryptocurrencies like Bitcoin. Cryptocurrencies operate on decentralized networks powered by blockchain technology, offering an alternative to traditional fiat currencies. Due to its decentralized structure, which guarantees transaction immutability, security, and transparency, blockchain is a popular choice for online payments.

Peer-to-Peer Payment Systems

Peer-to-peer (P2P) payment systems have gained popularity as a convenient way to transfer funds directly between individuals. These platforms facilitate peer-to-peer transactions without the need for intermediaries, enabling users to send and receive money quickly and securely. P2P payment systems have become especially prevalent for splitting bills, sharing expenses, and making informal payments among friends and family.

Biometric Authentication in Payments

Advancements in biometric technology have revolutionized authentication methods in online payments. Biometric authentication techniques such as fingerprint scanning, facial recognition, and iris scanning offer enhanced security and convenience for users. By leveraging biometric data, online payment systems can verify the identity of users with greater accuracy, reducing the risk of unauthorized transactions and identity theft.

AI and Machine Learning in Payment Processing

Artificial intelligence (AI) and machine learning algorithms are increasingly being utilized in payment processing to detect and prevent fraudulent activities. These technologies analyze vast amounts of transaction data in real time to identify suspicious patterns and anomalies. By continuously learning from new data, AI-powered fraud detection systems can adapt to evolving threats and protect against fraudulent transactions more effectively.

Contactless Payments and Wearable Technology

Contactless payment methods have gained widespread adoption, allowing users to make transactions quickly and securely with a simple tap or wave of their card or smartphone. The integration of payments into wearable devices such as smartwatches and fitness trackers further enhances the convenience of contactless payments, enabling users to make purchases on the go without the need for physical wallets or cards.

Regulatory Framework and Compliance

The evolution of online payment systems has been accompanied by the implementation of regulatory frameworks and compliance standards to ensure the security and integrity of financial transactions. Governments and regulatory bodies around the world have introduced laws and regulations to govern online payments, protect consumer rights, and combat money laundering and fraud. Compliance with these regulations is essential for businesses operating in the online payment space to maintain trust and credibility among customers.

Globalization and Cross-Border Payments

The increasing interconnectedness of the global economy has led to a surge in cross-border transactions, necessitating efficient and cost-effective payment solutions. However, cross-border payments present unique challenges such as currency conversion, regulatory compliance, and international banking regulations. Innovations in online payment systems aim to address these challenges and facilitate seamless cross-border transactions for businesses and individuals worldwide.

Future Trends and Innovations

Looking ahead, the evolution of online payment systems is poised to continue with the emergence of new technologies and innovative solutions. Trends such as voice-activated payments, biometric wearables, and decentralized finance (DeFi) are expected to shape the future of online payments. As technology evolves and consumer preferences evolve, online payment systems will continue to adapt and innovate to meet the changing needs of the digital economy.

Conclusion

The evolution of online payment systems has transformed the way we conduct financial transactions, offering convenience, security, and efficiency in the digital age. From the early days of electronic transfers to the emergence of cryptocurrencies and biometric authentication, the journey of online payments has been marked by innovation and adaptation. As technology continues to advance and consumer behavior evolves, online payment systems will play an increasingly pivotal role in shaping the future of commerce and finance.

FAQs (Frequently Asked Questions)

- What are online payment systems? Online payment systems are mechanisms that enable individuals and businesses to conduct financial transactions over the Internet securely and efficiently.

- How have online payment systems evolved? Online payment systems have evolved from basic electronic transfers to sophisticated platforms incorporating features like mobile payments, biometric authentication, and cryptocurrency.

- What role do payment gateways play in online transactions? Payment gateways act as intermediaries between merchants and financial institutions, facilitating secure and seamless transactions by verifying payment details and detecting fraud.

- What are the benefits of mobile payments? Mobile payments offer convenience, flexibility, and security, allowing users to make transactions using their smartphones without the need for physical cards or cash.

- How are regulatory frameworks shaping the online payment industry? Regulatory frameworks govern online payments to ensure security, compliance, and consumer protection, fostering trust and credibility in the digital economy.